How the Average Cost of an Item Is Calculated

Contents

Overview

A stock item's cost on any given day - the average cost - is subject

to change, based on several factors. Average cost depends on...

- the cost of the item in the current inventory

- cost changes on new receipts for incoming orders of the item

- cost changes from matching new invoices for the item (i.e., Invoice Price

Exceptions)

- manual adjustments to cost, if any.

This topic describes how average cost can change as a result of these related

factors. Several scenarios illustrate how average cost changes.

In general: When on-hand quantity is present for an item, average cost equals the inventory value divided by the on-hand quantity. When on-hand quantity is zero, average cost equals the lowest UOM cost for the primary supplier.

In general: When on-hand quantity is present for an item, average cost equals the inventory value divided by the on-hand quantity. When on-hand quantity is zero, average cost equals the lowest UOM cost for the primary supplier.

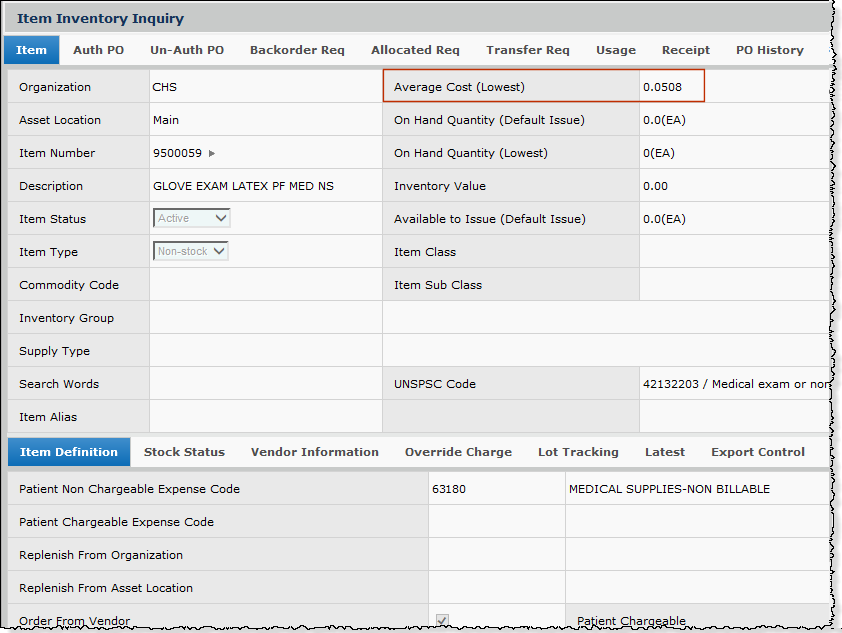

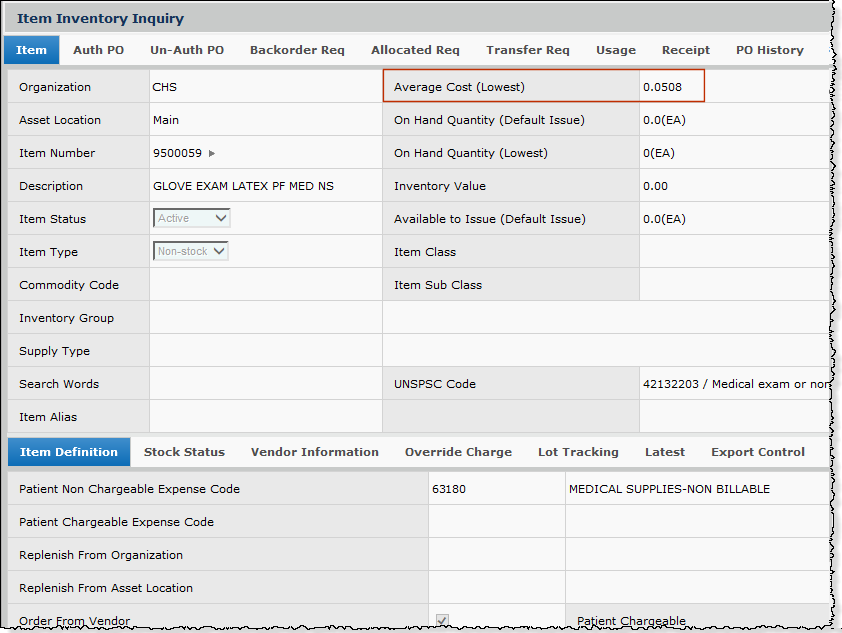

You can view the average cost of an item from the Item Inventory Inquiry panel (Figure 1).

To display the Item Inventory Inquiry panel

- From the Materials main Contents, select Inventory > Item Inventory.

- Click i next to

the item you are interested in.

Figure 1 - Item Inventory Inquiry Panel: Average Cost

Average Cost Formula

Supply Chain's calculation of average cost is a mean:

(Inventory Value + Receipt Extended Cost)

Average Cost = ---------------------------------------------------------------

(On

Hand Quantity + Receipt Quantity)

Example of Average Cost - Basic Calculation

| Item: |

On-hand Qty |

20 |

| |

Inventory Value |

$150.00 |

| |

Average Cost |

$7.50 |

| Receipt: |

Receipt Qty |

50 |

| |

Receipt Price |

$8.50 |

| |

Receipt Extended Cost |

$425.00 |

| New Average Cost = |

($150.00 + $425.00) / (20 + 50) |

| Avg Cost |

$ 8.21 |

Scenarios

In the following scenarios,the items discussed are stock items.

Received quantity has a higher cost than on-hand quantity

Average cost changes as a result of matching an invoice for an item at a higher

price than the inventory cost.

The item's inventory is lower than an incoming receipt for the item.

| |

Beginning OHQ=0 |

|

| To inventory: |

Receive 10 items @ $5.00 |

$50.00 |

| To departments: |

Issue 9 items |

OHQ=1 |

@ $5.00 |

| Invoice match: |

10 items @ 7.00 |

RCTQ=10 |

$70.00 |

Average Cost: ( 0 + $70.00) / ( 0 + 10) = $7.00

Current Inventory Value (1 item) = $7.00

Accounts

| Inventory / Storeroom |

| 50.00 |

|

| |

45.00 |

| A

20.00 |

|

| |

B 18.00 |

|

| PO Liability |

| |

50.00 |

| |

A 20.00 |

|

|

| Inventory Adjustment |

|

B 18.00 |

|

| |

|

|

|

B Computation

for adjustment to inventory:

(Invoice Qty - OHQ) * (Receipt_Price - Invoice_Price)

(10 - 1) * (5.00 - 7.00) = -18.00

|

| |

A quantity of the item exists in inventory. A receipt adds items to inventory

at a higher price.

| |

Beginning OHQ=9 |

|

| To inventory: |

Receive 10 items @ $5.00 |

|

$50.00 |

| Adjustment |

Adjust price of 9 items (OHQ=19) |

$45.00 |

| Invoice match: |

10 items @ 7.00 |

RCTQ=10 |

$70.00 |

Current Inventory Value (1 item) = $115.00

Average Cost: ( $45.00 + $70.00) / ( 9 + 10) = $115.00 / 19 = $6.05

Accounts

| Inventory / Storeroom |

| 50.00 |

|

| 45.00 |

|

| 20.00 |

|

|

|

| Inventory

Adjustment |

| |

45.00 |

|

|

|

|

Received quantity has a lower cost than on-hand quantity

The examples below show how average cost changes as a result of matching an

invoice for an item at a lower price than the inventory cost.

In this case, the inventory quantity is less than the received quantity.

| |

Beginning OHQ=0 |

|

| To inventory: |

Receive 10 items @ $5.00 |

$50.00 |

| Adjustment |

Issue 9 items |

$45.00 |

| Invoice match: |

10 items @ $2.00 |

$20.00 |

Ending Inventory Value (1 item) = $2.00

Average Cost: ( $20.00 + $2.00) / (1 + 10) = $2.00

Accounts

| Inventory / Storeroom |

| 50.00 |

|

| |

45.00 |

| |

A 30.00 |

| B 27.00 |

|

|

| PO Liability |

| |

50.00 |

| A 30.00 |

|

|

|

| Inventory Adjustment |

| |

B 27.00 |

| |

|

|

|

B

Computation for adjustment to inventory:

(Invoice

Qty - OHQ) * (Receipt_Price - Invoice_Price)

(10

- 1) * (5.00 - 2.00) = 27.00

|

| |

The inventory quantity is greater than the received quantity.

| |

Beginning OHQ=9 |

|

| To inventory: |

Receive 10 items @ $5.00 |

$50.00 |

| Adjustment |

Adjust price of 9 items |

$45.00 |

| Invoice match: |

10 items @ $2.00 |

$20.00 |

The ending inventory quantity is 19 items, with a total value of $65.00 calculated

as follows:

$50.00 + $45.00 is debited to inventory (for a

receipt and a cost adjustment).

$30.00 is credited to inventory (the difference between

the receipt cost and the invoice price -- $50.00 - $20.00).

The average cost of the item is $3.42 ($65.00 / 19).

Accounts

| Inventory / Storeroom |

| 50.00 |

|

| 45.00 |

|

| |

A 30.00 |

|

| PO

Liability |

| |

50.00 |

| A 30.00 |

|

|

| Inventory

Adjustment |

| |

45.00 |

|

|

|

|

On-hand quantity becomes zero before invoice is matched

In this example, initial inventory of the item is zero. A quantity of the item

is received, and immediately issued before an invoice is matched.

| |

Beginning OHQ=0 |

|

| To inventory: |

Receive 10 items @ $5.00 |

$50.00 |

| Issue: |

Issue 10 items @ $5.00 |

$50.00 |

| Invoice match: |

10 items @ $7.00 |

$70.00 |

The ending inventory quantity is 0 with a total value of $0.00.

The average cost is $5.00 (0 + $50.00) / (0 + 10).

$20.00 from the invoice total cost is debited to Inventory Adjustment.

Accounts

| Inventory / Storeroom |

| 50.00 |

|

| |

50.00 |

| A 20.00 |

|

| |

B 20.00 |

|

| PO Liability |

| |

50.00 |

| |

A 20.00 |

|

| Inventory Adjustment |

| 50.00 |

|

| A 20.00 |

|

|

B Computation

for adjustment to inventory:

(Invoice

Qty - OHQ) * (Receipt_Price - Invoice_Price)

(10-0)

* (5.00 - 7.00) = -20.00 |

Copyright © 2023 by Premier Inc. All rights reserved.

![]() In general: When on-hand quantity is present for an item, average cost equals the inventory value divided by the on-hand quantity. When on-hand quantity is zero, average cost equals the lowest UOM cost for the primary supplier.

In general: When on-hand quantity is present for an item, average cost equals the inventory value divided by the on-hand quantity. When on-hand quantity is zero, average cost equals the lowest UOM cost for the primary supplier.