This topic discusses: |

Links to related topics: |

|

Invoices

Purchase orders |

|

| Search Online Doc | |

| Current Release Notes | |

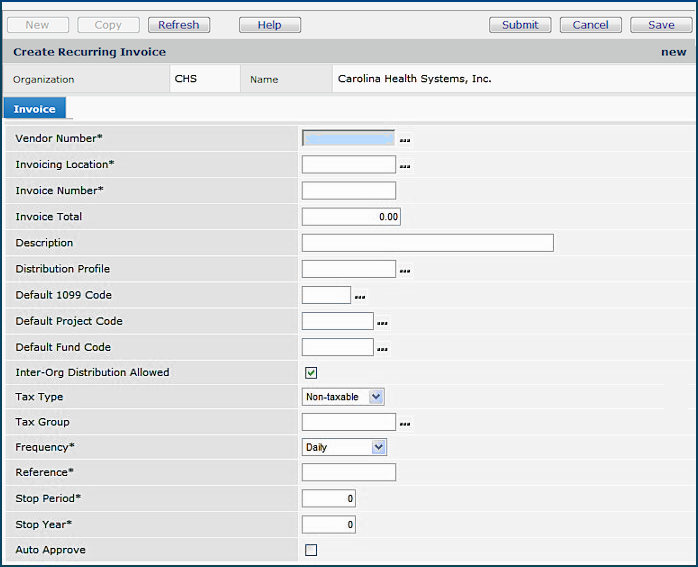

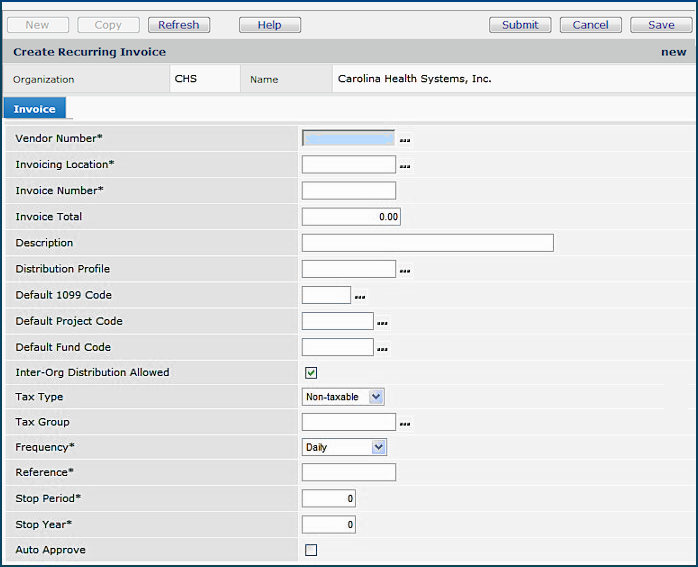

Recurring invoices are templates for invoice information used to create "real" invoices over and over again. When you set up a recurring invoice, you use it to generate a manual invoice. A manual invoice is not associated with a materials purchase order.

To process a recurring invoice means to select the recurring invoice and create a "real" manual invoice from it. Since recurring invoices are only templates for actual invoices, recurring invoices are not matched. Recurring invoices also do not get approved, paid, etc. When the recurring invoice creates a real invoice, the real invoice will appear in the Invoices list and the Invoice Created column indicates "recurring."

You can use the invoice approvals process with recurring invoices. For details, see Using approval processing with recurring invoices.

- The invoice in Figure 1 has a Tax Type of Sales taxable. A Tax Type is defined for each vendor AP location. Options are: Sales taxable, Use taxable, Non-taxable. The system populates the Tax Type field from the tax information in the vendor AP location record.

- A Tax Group contains a group of related taxes, tax expense and liability accounts for each tax in the group, and a distribution method. If the invoice is taxable, and you have enabled tax processing for AP, the system calculates the tax for each goods line using the Tax Group settings.

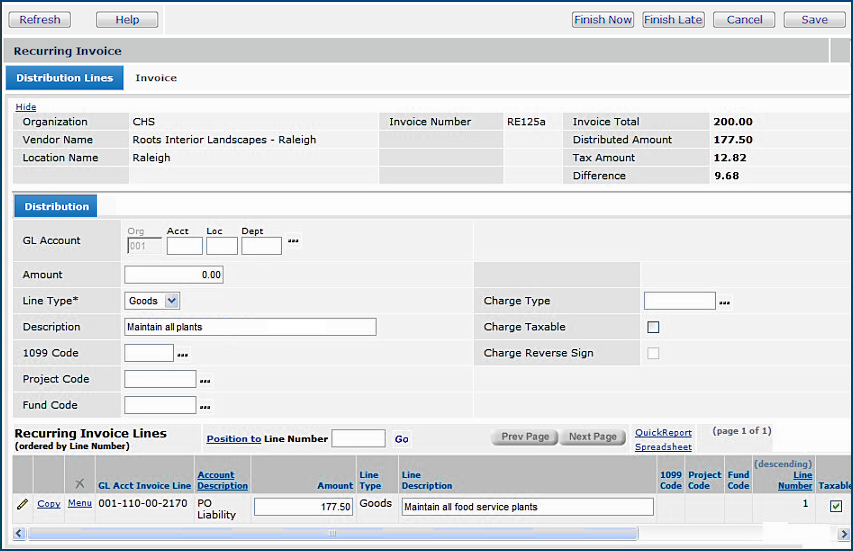

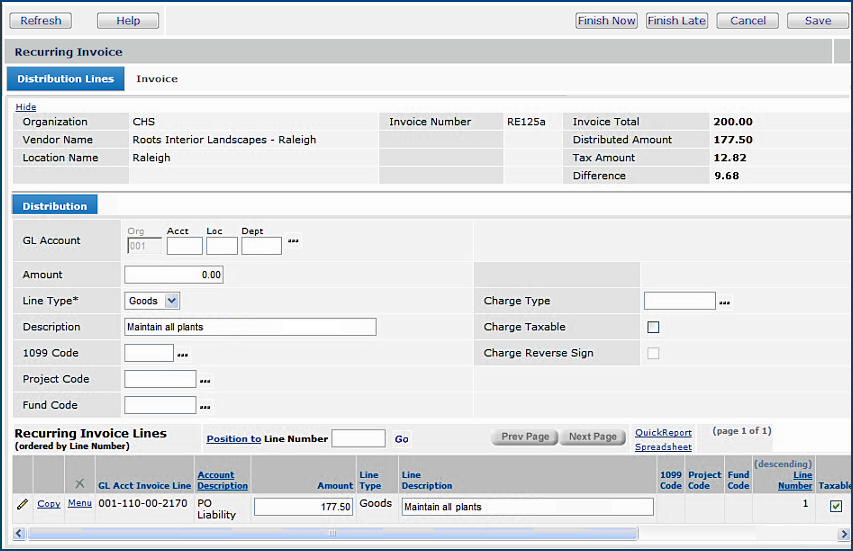

Notice that the Charge Taxable box (Figure 2) has not been checked on

the Distribution Lines tab. On the distribution line at the bottom to the far right, Taxable is checked.

The system automatically marks the goods lines as "taxable" because,

in this case, the AP location is specified as taxable, and the organization

has enabled AP tax processing. (See Setting Up Tax

Information for Accounts Payable.)

When tax applies to the invoice, the system automatically calculates the tax for

each taxable line. A running total of the calculated tax amount is in the Tax

Amount field (on the top right side of the invoice header).

To build a charge line, enter charge line information on the Distribution Lines tab in the same way that you entered goods lines:

Select a Charge Type.

Each charge type assigns charges to general ledger accounts according to

a specified Distribution Method.

The distribution methods are:

Pro-rate - Allocates charges to each goods line's account in proportion to the total goods amount. On the invoice, you do not need to enter a GL account for the charges since they will be spread among goods accounts when the invoice is approved.

Spread Evenly - Allocates an equal amount of the charges to each goods line when the invoice is approved.

Single GL Account - Allocates the total charge amount to one GL account. Instructions for identifying the account are below.

Manually - You must select the GL account for the charge on the invoice.

The Invoice Total (Figure 3, upper right corner) should equal the Distributed Amount plus any Tax Amount, and the Difference should be zero. Otherwise, the recurring invoice will be Incomplete, and you will not be able to process it.

Review the information on the General, Payment, Discount, Tax, and Recurring tabs. Enter new information, or make changes as needed.

(Note that you can save your work at any time, but you should be sure to click Save before you exit from the Edit panel.)

Finish Now - creates the recurring invoice and adds it

to the list of recurring invoices in Complete status.

Finish Later - creates the recurring invoice and adds it

to the list of recurring invoices. However, its status is Incomplete

because the invoice is "unfinished." You must edit the invoice

and click Finish Now to be able to use it.

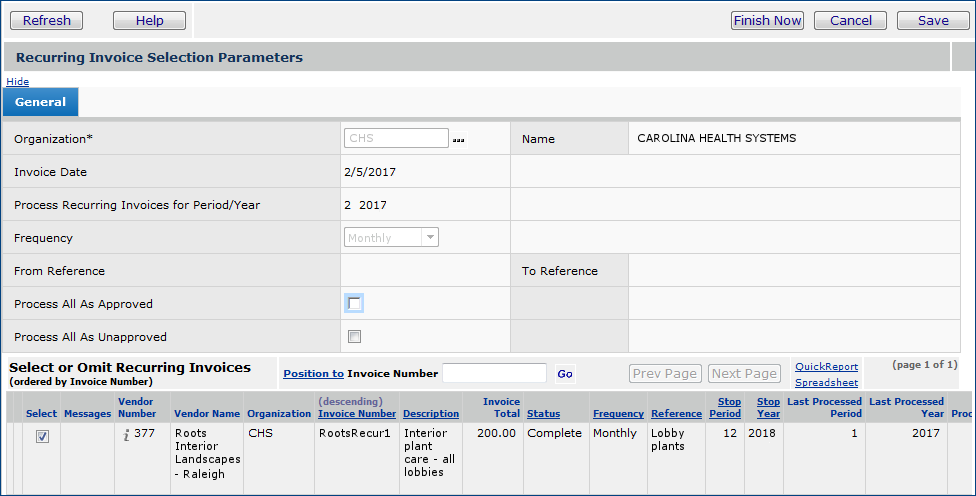

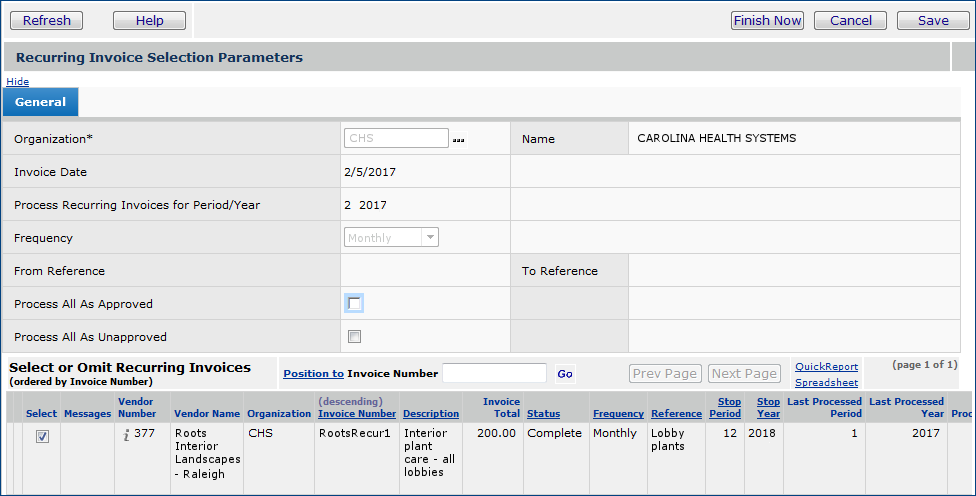

The invoice is listed on the panel Create and Process Recurring Invoice Batches while it is being processed. When the invoice finishes processing successfully, it disappears from the list, and reappears on the Invoices list (Invoicing > Invoices). On the Invoices list, the Match Status is No Match, and the Invoice Created column contains From Recurring Invoice.

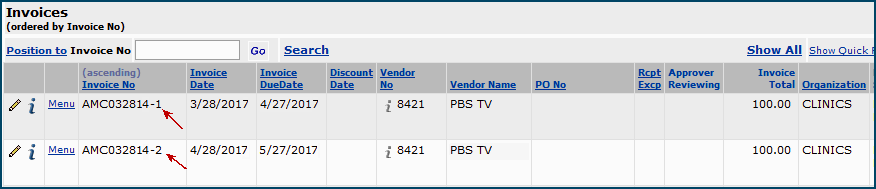

Invoice numbers shorter than or equal to 29 characters are appended with the instance (or recurring count) of the invoice.

Figure 7 displays a recurring invoice that has been processed twice.

On the recurring invoice, note the integers (1 and 2) with a hyphen appended to the invoice number for each instance of processing. On a recurring invoice , the Invoice Due Date is calculated from payment terms, which default from the vendor AP location.

Copyright © 2023 by Premier Inc. All rights reserved.